Distributors can now sell dematerialized, private gift cards on the Orchestra platform.

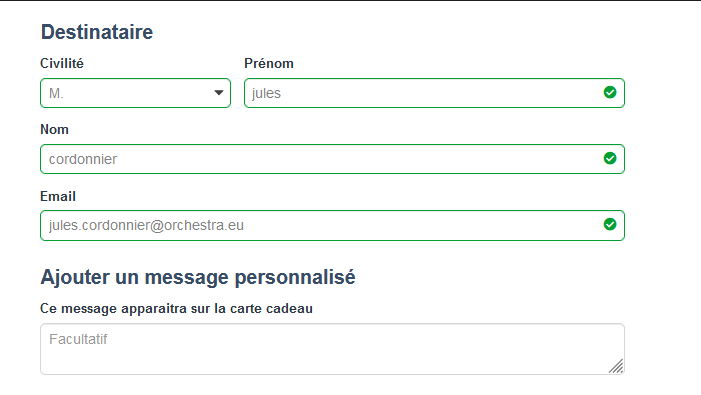

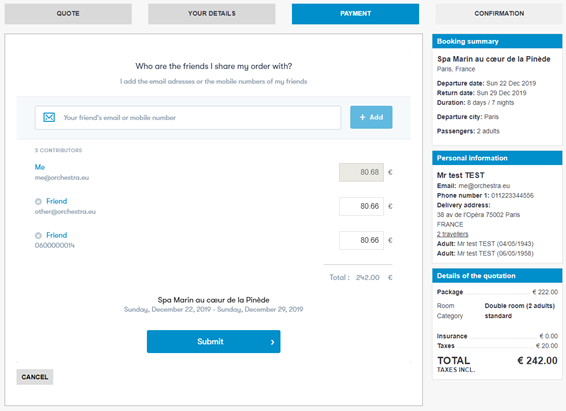

A dedicated booking process has been set up, enabling a customer to purchase an e-gift card and offer it to a beneficiary, for use on the distributor’s e-commerce website where it was purchased.

When an e-gift card is purchased, an automatic code is generated and emailed to the customer, who can then offer it to the beneficiary of their choice, adding a personalized message.

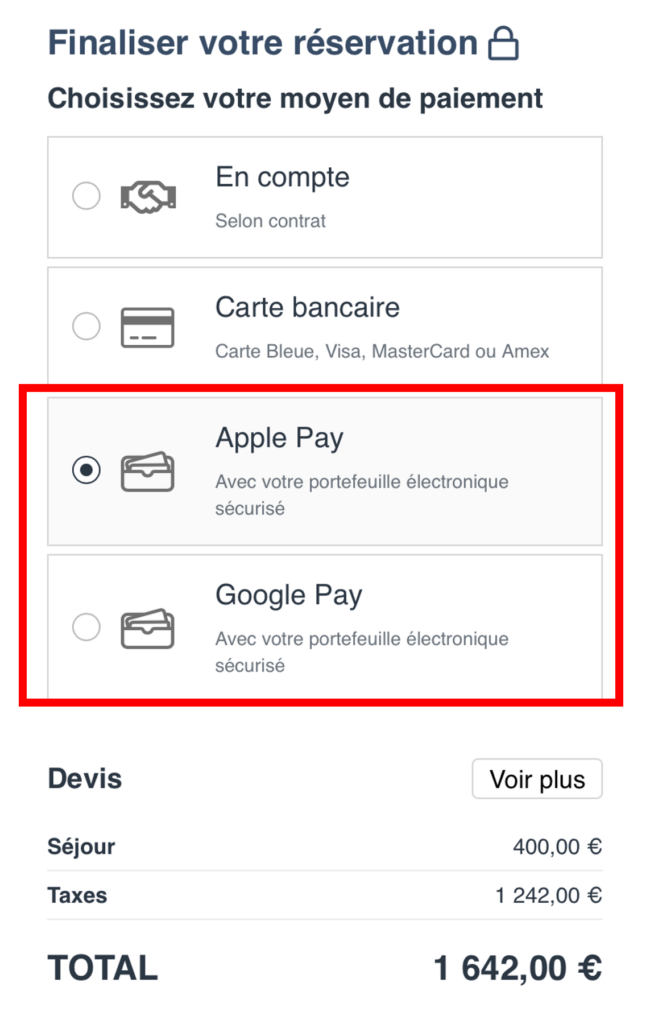

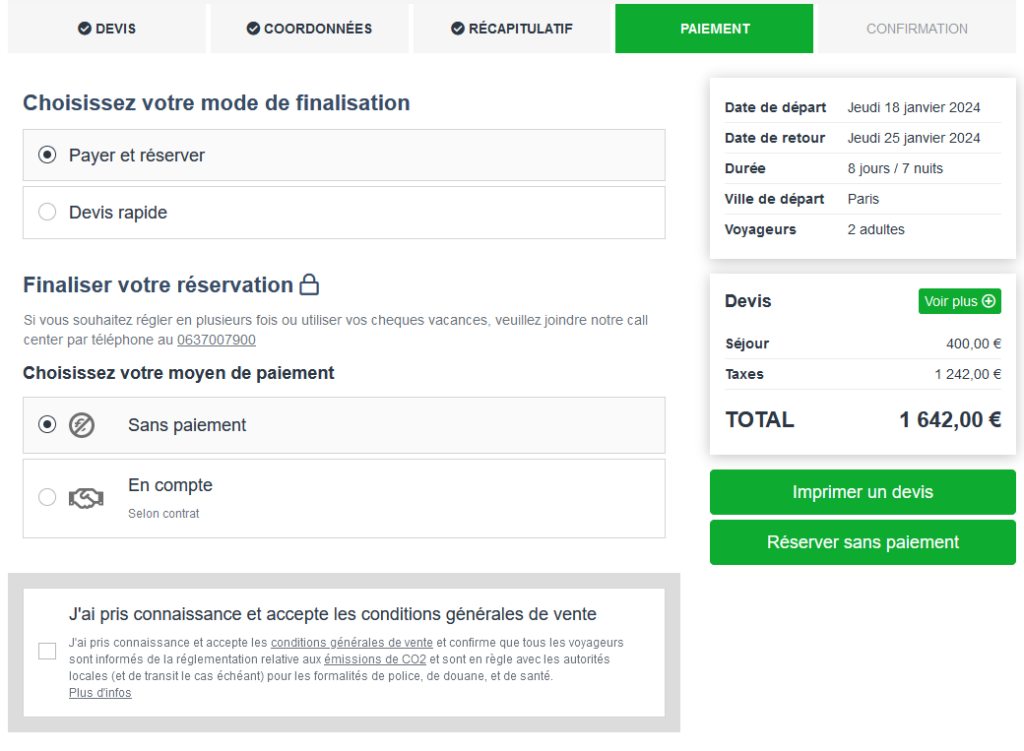

The e-gift card can then be used in the distributor’s e-commerce booking process, with a possible additional payment if the amount on the e-gift card is insufficient to cover the total cost of the order.

Finally, the distributor can define the validity period of the e-gift card.